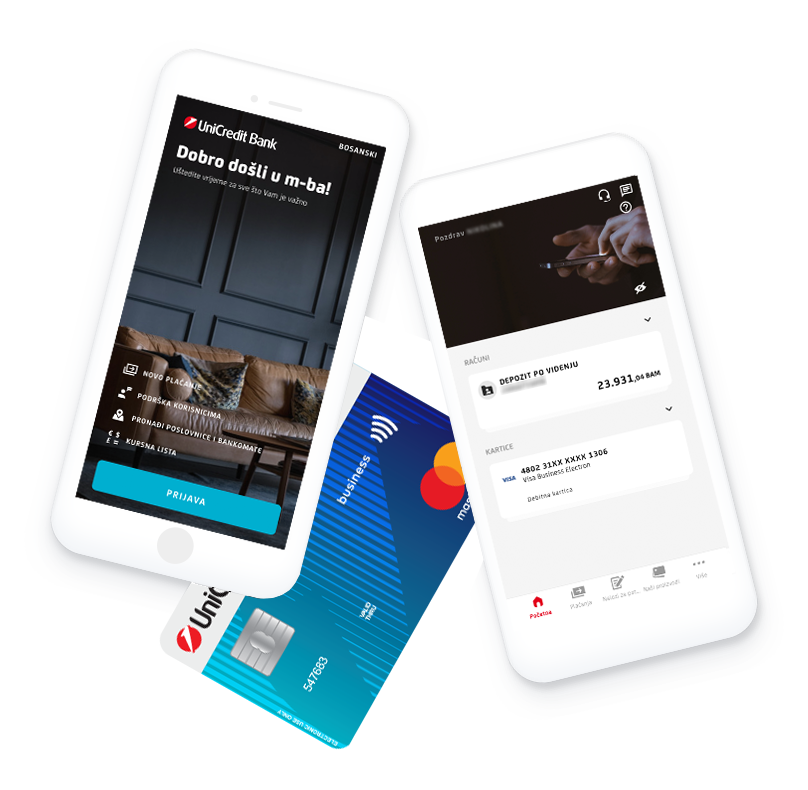

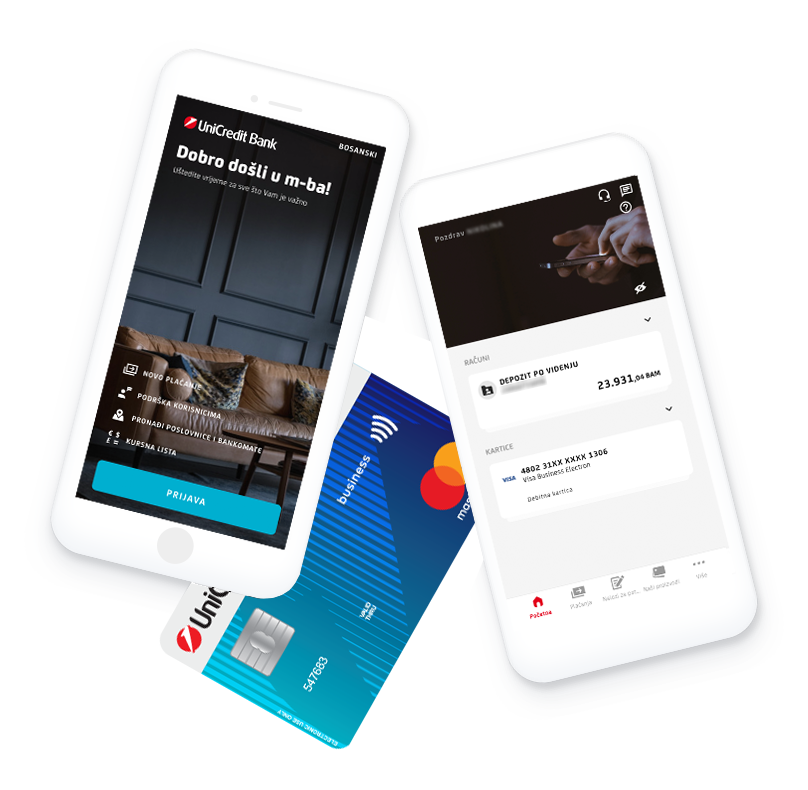

Bank in the palm of your hand

UniCredit On Mobile

Download app on the links

To get the best possible experience using our website we recommend that you upgrade to a newer version or other web browser

Online Banking is available for Retail Customers who have Current accounts and use other products. You can use it to see your Account and card balance, make payments, manage your budgets and other features. For accessing it you need One-time password generator - e.g. Hardware token or Mobile Token device. For more information and troubleshooting please call Customer Support on telephone number 080 081 051 (from abroad +387 33 567 460).

Help-desk for technical support, installation, certificate renewal - contact: +387(0)36 289 900 e-mail: mailto:ebaplus@unicreditgroup.ba

For questions about application options contact: +387(0)36 356 356 e-mail: mailto:e-banking@unicreditgroup.ba

Help-desk for technical support, installation, certificate renewal - contact: +387(0)36 289 900 e-mail: mailto:ebaplus@unicreditgroup.ba

For questions about application options contact: +387(0)36 356 356 e-mail: mailto:e-banking@unicreditgroup.ba

Limit the trade risk and find the best solution for your business transactions together with UniCredit Bank.

UniCredit Bank, as a stable and globally recognised partner, is pleased to offer a new product to both the existing and future counterparts, to satisfy their requirements and expectations. Receivables financing is a specific form of supplier financing provided by UniCredit Bank based on the supplier’s quality, undue receivables owed by buyers for delivered goods and/or provided services. This way UniCredit Bank enables companies to remain focused on their core activity, rather than on the collection of receivables.

We would like to establish a long-term business cooperation based on the mutual trust.

UniCredit Bank will finance the receivables which the supplier has towards the customer and transfer the funds to the supplier's account in the nominal value of the receivables decreased by the Bank fees. By signing an Agreement on Receivables Financing , the Supplier assigns its receivables to the Bank. This enables the supplier to collect the value of the invoice/sales contract, reduced by the applicable Bank fee, prior to the payment due date set in the contract

The Bank finances direct undue receivables which are documented, undisputed and acknowledged by the buyer and have a clearly specified due date. The scope of financing are the receivables arising from a commercial sales contract.

For further details please contact UniCredit Bank Structured Trade and Export Finance Unit: ReceivableFinance@unicreditgroup.ba

Boost your liquidity, limit the trade risk and find the best solution for your business transactions together with UniCredit Bank.

Letter of Credit (LC) is a payment instrument, which represents a bank’s written obligation, undertaken at a request of the bank's client, to pay a certain amount of a specified currency to the beneficiary, provided that the beneficiary submits to the bank precisely required documents showing that goods were delivered or services provided within a certain time period.

Letters of Credit are subject to Uniform Customs and Practice of the International Chamber of Commerce (ICC) Paris.

UniCredit Bank is a leading institution with internationally certified specialists who will provide you with the best quality service in LC-related business (both documentary and stand-by). In addition to LC processing in accordance with ICC rules, we provide expert assistance in completing an LC Issuing Order, drafting a wording of an LC , checking of documents under export and import LC, and we also organise presentations for clients and their partners.

When to use a documentary letter of credit?

A transaction which results from a purchase or sales of goods becomes much more complex due to the following reasons:

What is forfaiting?

Purchase of receivables under confirmed/unconfirmed export Letters of Credit with deferred payment represents a model of financing the exporter.

Use forfaiting under an Export LC to convert your receivables to cash and improve your liquidity!

Collection (Clean and Documentary) - Seller's order instructing the bank to deliver the submitted documents to the buyer via a correspondent bank in the buyer's country, provided the buyer pays immediately or accepts the draft drawn to him.

For further details please contact UniCredit Bank Trade and Export Finance Unit: Tradefinance@unicreditgroup.ba

A bank guarantee is an irrevocable obligation of the bank-guarantor to pay upon first written demand to the beneficiary the amount due within a specified maximum and in accordance with he guarantee terms, in the event that a third party failed to comply with the underlying contract.

UniCredit Bank, as a stable and globally recognised guarantor issues both local and international guarantees as a security in various types of business transactions – from construction and sale contracts to the settlement of financial liabilities, such as loans and their repayment.

UniCredit Bank is a leading institution with internationally certified specialists who will provide you with the best quality service in guarantee-related business both in the country and abroad.

A bank guarantee is a reliable security instrument in either domestic or foreign trade. It mitigates various types of risk:

For further details please contact UniCredit Bank Trade and Export Finance Unit: Tradefinance@unicreditgroup.ba

Download app on the links

Loading

With aim to improve your user experience UniCredit Bank d.d. uses cookies (also Analytical, Advertising, and Third-party Cookies) on our website. If you agree to the installation of all the listed cookies, click ''Accept All Cookies'', otherwise you can always edit the consents in ''Cookie Settings''. Here you can find more information about cookies .